What Is The Optimal Credit Range And How To Achieve It?

What is Excellent Credit Range?

Introduction

Greetings, Smart Peoples! In this article, we will delve into the topic of what is excellent credit range. Having a good credit score is essential for financial well-being, and understanding the range of excellent credit can help individuals make informed decisions regarding their finances. In this comprehensive guide, we will explore what excellent credit range entails, who can achieve it, when and where it matters, why it is important, and how it can be achieved. So, let’s dive in and explore the world of excellent credit!

1 Picture Gallery: What Is The Optimal Credit Range And How To Achieve It?

What is Excellent Credit?

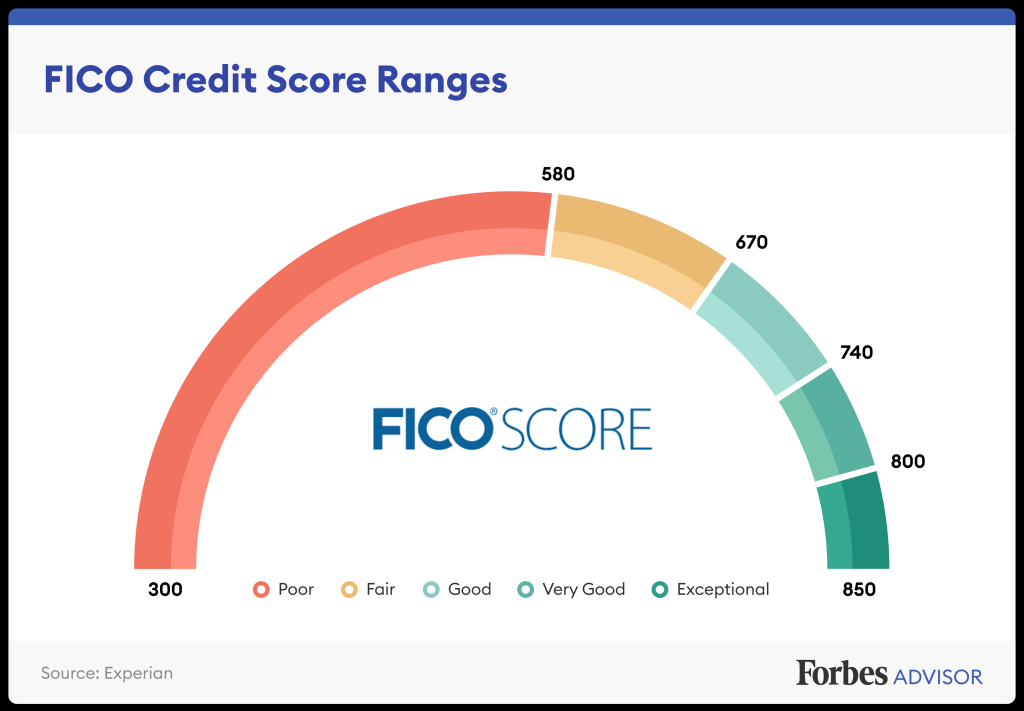

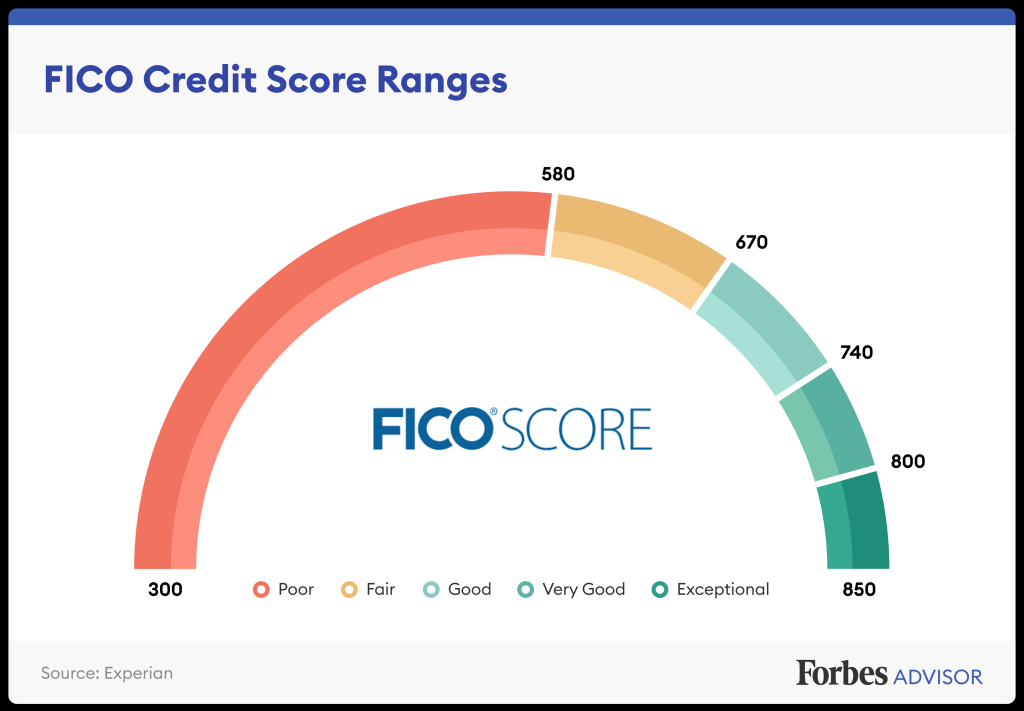

🔍 Excellent credit refers to a credit score that falls within a specific range, indicating a high level of creditworthiness. Credit scores are numerical values that help lenders assess an individual’s credit risk. The range for excellent credit typically varies depending on the credit scoring model being used, but it generally falls between 800 and 850.

Image Source: forbes.com

🔍 A credit score is calculated based on several factors, including payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Those with excellent credit demonstrate responsible financial behavior, such as paying bills on time, keeping credit card balances low, and maintaining a diverse credit portfolio.

Who Can Achieve Excellent Credit?

🔍 Achieving excellent credit is an accomplishment that is within reach for many individuals. It is not limited to a specific demographic or income level. Anyone who consistently practices good financial habits and manages their credit responsibly can aim for and achieve an excellent credit score.

🔍 Young adults starting their financial journey, as well as seasoned individuals with established credit histories, can work towards attaining excellent credit. However, it is important to note that building excellent credit takes time and requires responsible financial behavior over an extended period.

When and Where Does Excellent Credit Matter?

🔍 Excellent credit is highly valued by lenders, making it crucial in various financial scenarios. When applying for a mortgage, auto loan, or personal loan, having excellent credit can increase the likelihood of approval and secure more favorable interest rates and terms.

🔍 Additionally, excellent credit can also benefit individuals when renting an apartment, obtaining insurance coverage, or even applying for certain job positions. Landlords, insurance companies, and employers may review an individual’s credit history to assess reliability and responsibility.

Why is Excellent Credit Important?

🔍 Excellent credit opens doors to better financial opportunities. It provides individuals with greater access to credit products and services at competitive interest rates and favorable terms. With excellent credit, individuals can save money on interest payments, secure loans more easily, and enjoy other financial benefits.

🔍 Furthermore, maintaining excellent credit is crucial for building a solid financial foundation. It demonstrates financial responsibility and discipline, which can lead to greater financial freedom and peace of mind.

How Can Excellent Credit be Achieved?

🔍 Achieving excellent credit requires a combination of responsible financial habits and smart credit management. Here are some actionable steps to help you on your journey towards excellent credit:

Pay all bills on time: Timely payment of bills is a crucial factor in maintaining excellent credit.

Keep credit card balances low: Aim to keep your credit utilization ratio below 30%.

Maintain a diverse credit mix: Having a mix of credit types, such as credit cards and loans, can positively impact your credit score.

Avoid opening unnecessary credit accounts: Opening multiple credit accounts within a short period can negatively affect your credit score.

Regularly review your credit report: Check your credit report for errors and dispute any inaccuracies promptly.

Limit new credit inquiries: Applying for multiple lines of credit within a short timeframe can lower your credit score.

Practice patience and consistency: Building excellent credit takes time, so remain consistent with responsible financial habits.

Advantages and Disadvantages of Excellent Credit

Advantages:

Access to better interest rates and loan terms.

Higher chances of loan and credit approval.

Greater financial flexibility and options.

Lower insurance premium rates.

Improved bargaining power when negotiating financial agreements.

Disadvantages:

Pressure to maintain an excellent credit score.

Potential for increased credit limits and temptations to overspend.

Higher expectations from lenders and creditors.

Limited credit-building opportunities for individuals with no credit history.

Possible dependence on credit for financial needs.

Frequently Asked Questions

Q1: Is it possible to achieve excellent credit without a credit card?

A1: Yes, it is possible to achieve excellent credit without a credit card. Responsible management of other credit accounts, such as loans or utility bills, can contribute to building an excellent credit score.

Q2: How long does it take to achieve excellent credit?

A2: The time it takes to achieve excellent credit varies depending on individual circumstances. It can take several years of consistently practicing good financial habits to attain an excellent credit score.

Q3: Can one maintain an excellent credit score with high credit card balances?

A3: Maintaining high credit card balances can negatively impact your credit score. It is advisable to keep your credit card balances low to maximize your chances of maintaining an excellent credit score.

Q4: Does closing unused credit accounts affect one’s credit score?

A4: Closing unused credit accounts can potentially affect your credit score, especially if they have a long credit history. It is generally advisable to keep credit accounts open to maintain a healthy credit mix.

Q5: Can a single late payment affect an excellent credit score?

A5: While a single late payment can have a temporary negative impact on your credit score, it is unlikely to cause a significant drop if you have an excellent credit score. However, it is still important to strive for consistent on-time payments.

Conclusion

In conclusion, understanding what excellent credit range entails is essential for individuals aiming to improve their creditworthiness and financial well-being. Achieving excellent credit requires responsible financial habits, consistent credit management, and time. The advantages of excellent credit, such as access to better interest rates and financial flexibility, far outweigh the potential disadvantages. By following the actionable steps mentioned earlier and being patient and consistent, anyone can work towards attaining an excellent credit score. So, start taking control of your financial future and strive for excellent credit!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. It is always recommended to consult with a qualified financial professional before making any financial decisions.

This post topic: Excellent