Unlock Financial Opportunities With An Excellent Credit Score: Take Control Of Your Financial Future Today!

An Excellent Credit Score: Unlocking Financial Opportunities

Greetings, Smart Peoples! In today’s digital age, having an excellent credit score is more important than ever. It serves as a key that unlocks various financial opportunities and sets the stage for a secure financial future. Whether you’re planning to buy a home, start a business, or simply want to enjoy lower interest rates on loans and credit cards, maintaining a stellar credit score is crucial. In this article, we’ll explore the ins and outs of what constitutes an excellent credit score, who benefits from it, when and where it matters, why it’s essential, and how you can achieve and maintain it.

What is an Excellent Credit Score? 😃

3 Picture Gallery: Unlock Financial Opportunities With An Excellent Credit Score: Take Control Of Your Financial Future Today!

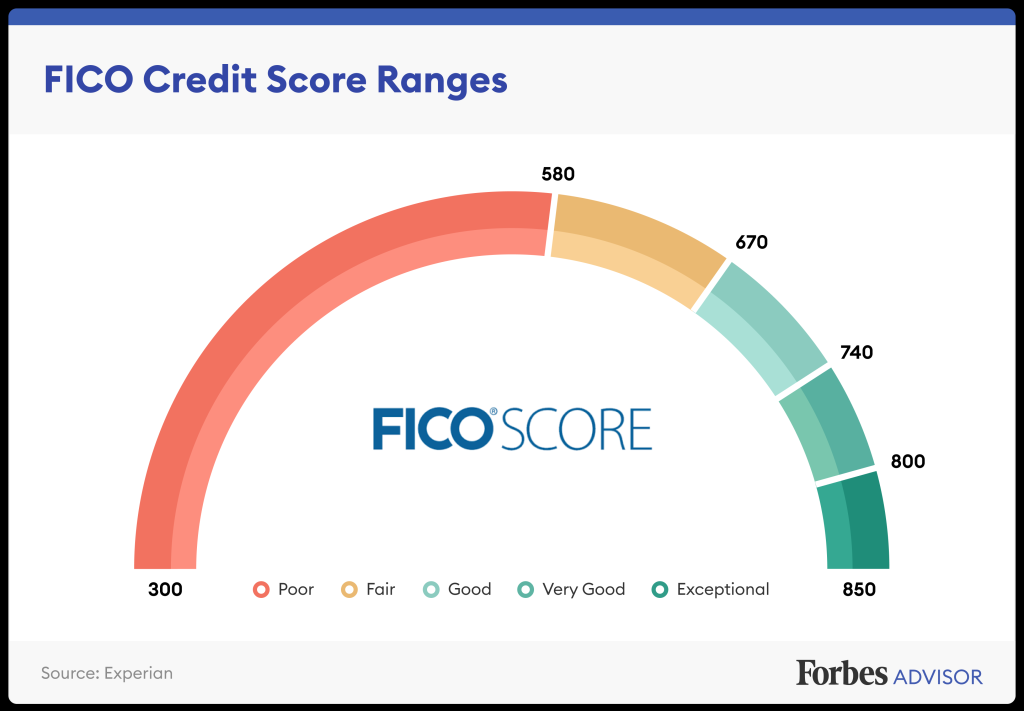

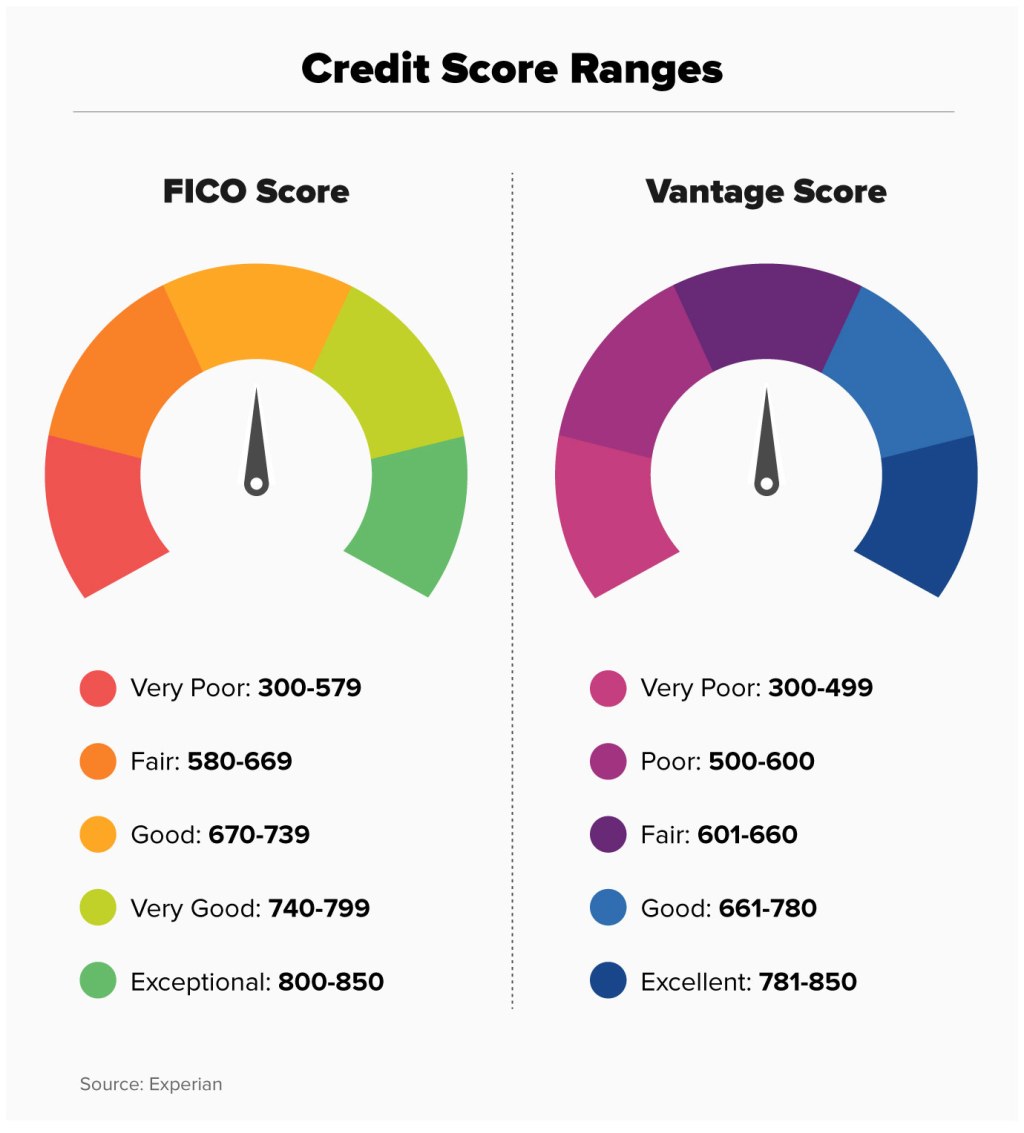

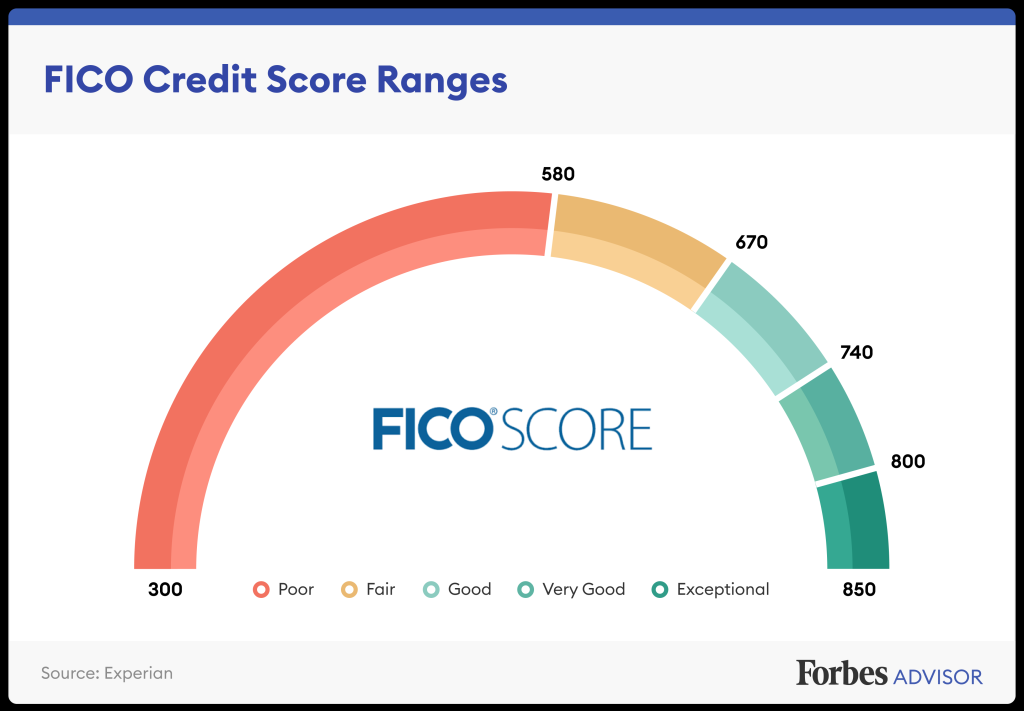

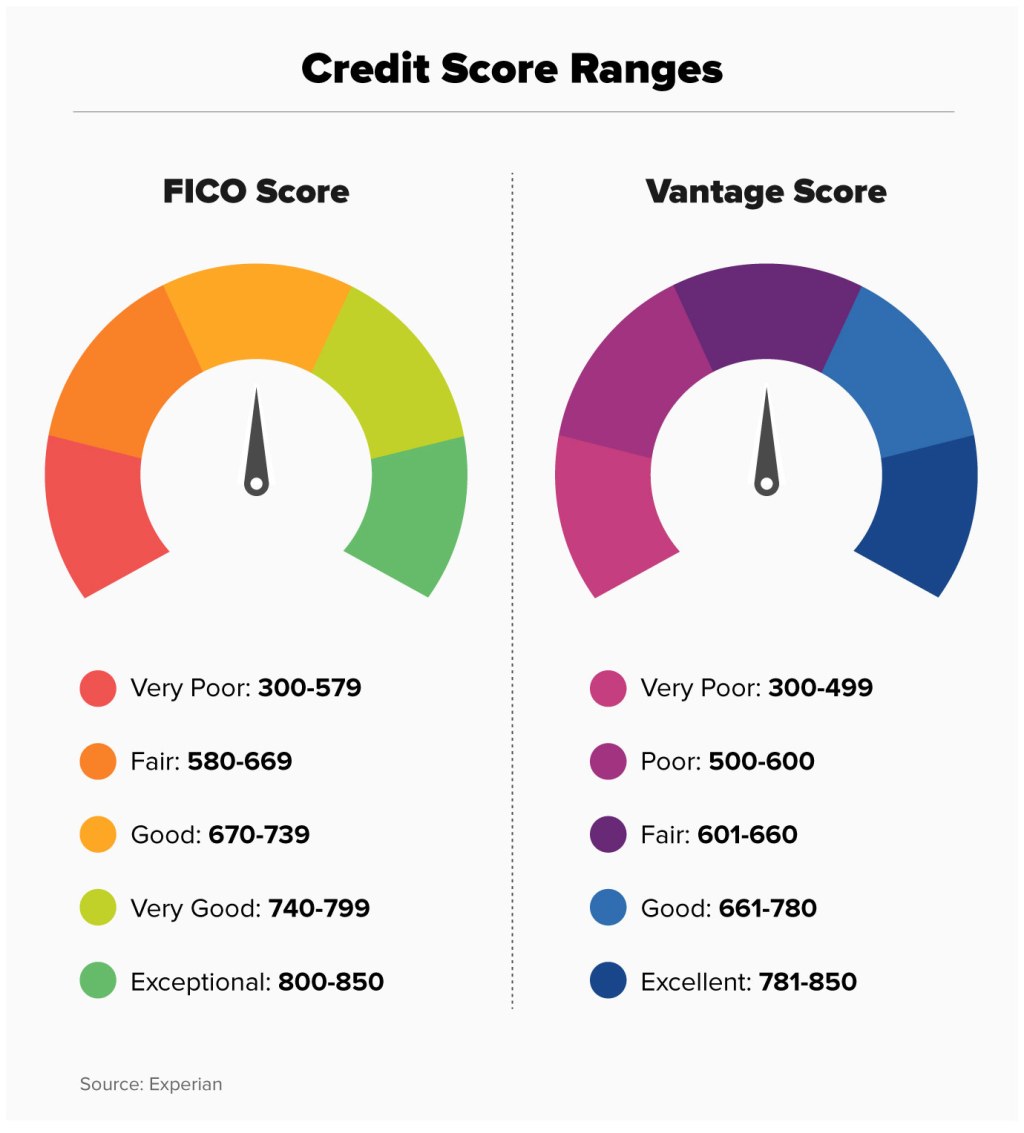

An excellent credit score is a numerical representation of your creditworthiness. It is a measure of how likely you are to repay your debts and fulfill your financial obligations. Credit scores typically range from 300 to 850, with higher scores indicating a lower risk for lenders. An excellent credit score generally falls within the range of 750 to 850, reflecting a responsible borrower who consistently pays bills on time and utilizes credit responsibly.

Who Benefits from an Excellent Credit Score? 🤔

Image Source: cnn.com

An excellent credit score benefits individuals from all walks of life. Whether you’re a young professional seeking your first credit card, a recent college graduate looking to secure a car loan, or a seasoned entrepreneur aiming to expand your business, a high credit score opens doors to favorable financial opportunities. Lenders, landlords, and even potential employers also rely on credit scores to assess an individual’s financial reliability and trustworthiness.

When and Where Does an Excellent Credit Score Matter? 📍

Your credit score matters in various situations and locations. When applying for a mortgage, landlords review credit scores to determine the risk of renting to you. When seeking a loan or credit card, lenders assess your creditworthiness to decide whether to approve your application and at what interest rate. Even insurance companies can consider your credit score when determining premiums. In short, an excellent credit score matters whenever you need to borrow money, rent a property, or secure insurance.

Why is an Excellent Credit Score Essential? 🌟

Image Source: forbes.com

Having an excellent credit score offers numerous advantages. It provides access to lower interest rates, allowing you to save money on loans and credit card balances. With a high credit score, you have more negotiating power when it comes to loan terms and interest rates. Additionally, a strong credit score can help you qualify for higher credit limits and better rewards on credit cards. It also contributes to your overall financial well-being and peace of mind.

How Can You Achieve and Maintain an Excellent Credit Score? 📈

Building and maintaining an excellent credit score requires discipline and financial responsibility. Start by paying your bills on time and in full each month. Keep your credit utilization ratio low by using only a small percentage of your available credit. Regularly check your credit report for errors and dispute any inaccuracies. Avoid opening unnecessary credit accounts and minimize credit inquiries. By following these practices consistently, you can establish and preserve an excellent credit score.

Advantages and Disadvantages of an Excellent Credit Score 🔍

Image Source: money.com

While an excellent credit score offers numerous advantages, it’s essential to be aware of the potential disadvantages as well. One advantage is the ability to access the best interest rates and loan terms. With a high credit score, you can qualify for premium credit cards with exclusive perks and rewards. On the other hand, a disadvantage of having an excellent credit score is the pressure to maintain it. Any missteps, such as late payments or high credit utilization, can cause a decline in your creditworthiness.

Frequently Asked Questions (FAQs) 👥

1. Can I improve my credit score quickly?

Improving your credit score takes time and consistent financial habits. However, by paying bills on time and reducing credit card balances, you can see gradual improvements over several months.

2. Does closing a credit card hurt my credit score?

Closing a credit card can impact your credit utilization ratio and, in turn, your credit score. If the card has a high credit limit and a low balance, it’s generally better to keep it open to maintain a healthy credit score.

3. How often should I check my credit score?

It’s wise to check your credit score at least once a year to monitor your financial health and address any errors. Some credit monitoring services also provide real-time updates and alerts for added convenience.

4. Can a high income guarantee an excellent credit score?

No, your income does not directly affect your credit score. However, a higher income can provide more financial stability, making it easier to manage your debts and maintain a good credit score.

5. Is it possible to have a perfect credit score?

While a perfect credit score of 850 is theoretically possible, it is extremely rare. Most lenders consider a score above 800 as excellent, so aiming for that range is a more realistic goal.

Conclusion: Take Charge of Your Financial Future 💪

In conclusion, an excellent credit score unlocks a world of financial opportunities. By understanding what it is, who benefits from it, when and where it matters, why it’s essential, and how to achieve and maintain it, you can take charge of your financial future. Prioritize responsible credit management, and reap the rewards of lower interest rates, increased borrowing power, and greater financial security. Start building your excellent credit score today!

Final Remarks 📝

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as financial advice. It is always recommended to consult with a qualified financial professional before making any credit-related decisions. Remember, your credit score is just one aspect of your overall financial health, and responsible financial habits extend beyond credit management.

This post topic: Excellent