Unlock Financial Success With Experian’s Excellent Credit Score – Click To Boost Your Future!

Excellent Credit Score Experian: A Path to Financial Success

Greetings, Smart Peoples! In today’s digital age, having a good credit score is crucial for financial stability and opportunities. One of the most reputable credit scoring agencies is Experian, which provides individuals with their credit scores based on various factors. In this article, we will dive deep into the world of excellent credit scores according to Experian, exploring what it is, who can benefit from it, when it matters, where to obtain it, why it is essential, and how to achieve and maintain it.

What is Excellent Credit Score Experian?

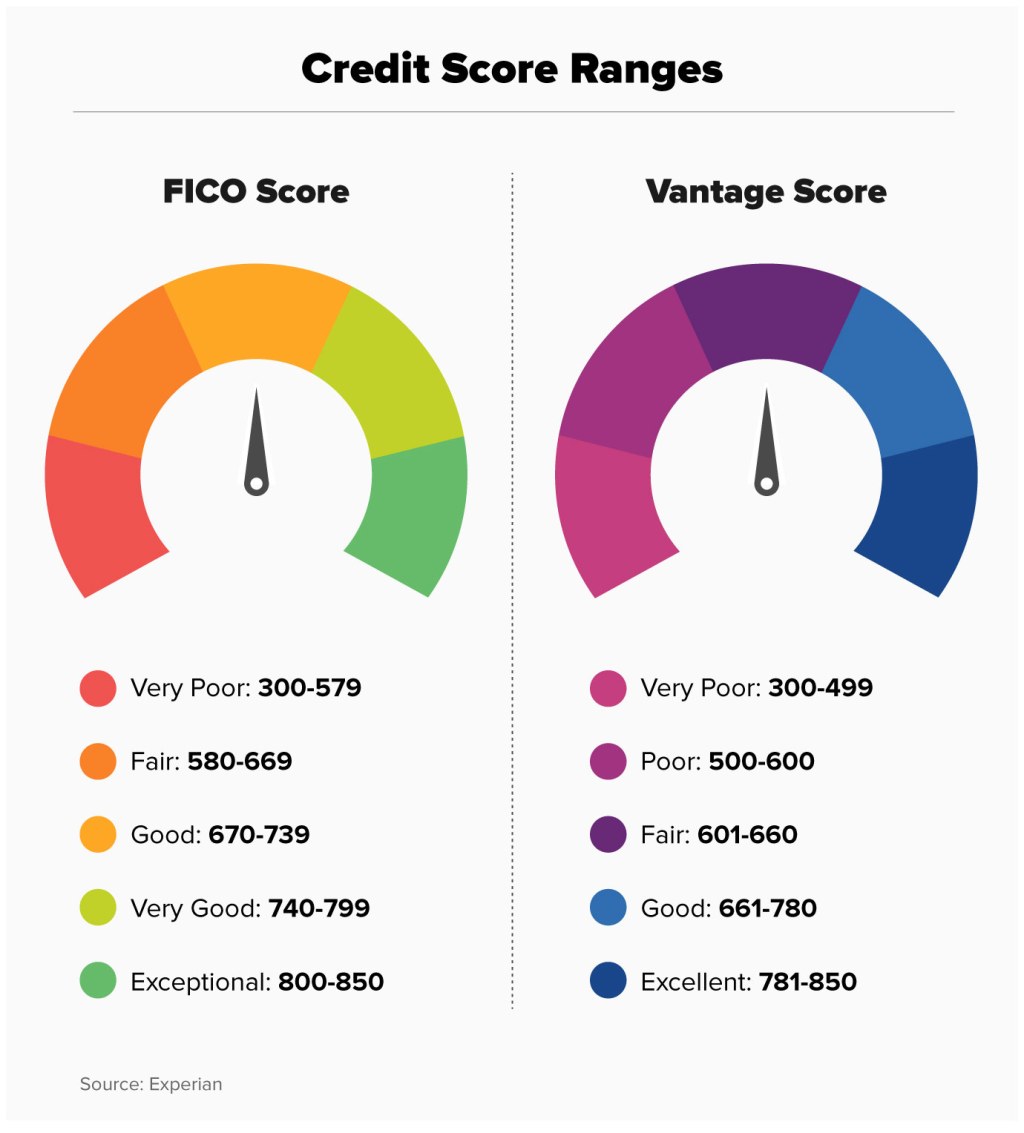

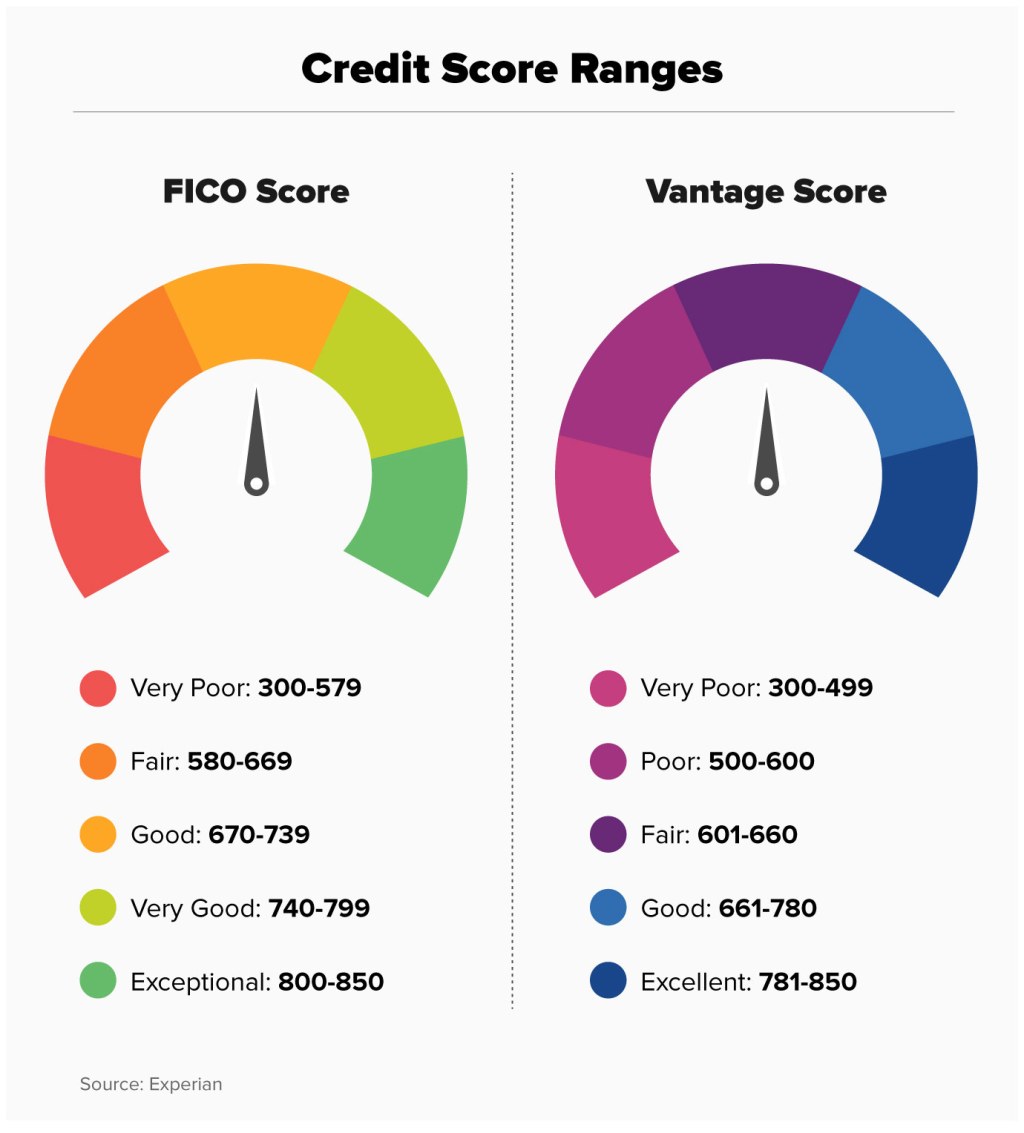

🔍 An excellent credit score according to Experian is a numerical representation of an individual’s creditworthiness. It ranges from 800 to 850, reflecting a history of responsible financial behavior and a low risk of defaulting on credit obligations. With an excellent credit score, individuals are more likely to be approved for loans, credit cards, and other financial products with the most favorable terms.

1 Picture Gallery: Unlock Financial Success With Experian’s Excellent Credit Score – Click To Boost Your Future!

Understanding the Components:

Experian considers several factors to calculate an individual’s credit score, including:

Payment history

Credit utilization ratio

Length of credit history

Credit mix

New credit inquiries

Image Source: money.com

Each of these components plays a crucial role in determining an excellent credit score. Maintaining a positive track record in these areas is vital for achieving a high score.

Who Can Benefit from an Excellent Credit Score?

🎯 An excellent credit score is beneficial to anyone who wants to secure the best financial opportunities and save money. It opens doors to lower interest rates on loans, higher credit limits, and attractive rewards on credit cards. Individuals with excellent credit scores are also more likely to receive favorable terms on mortgages, car loans, and insurance premiums.

Target Audience:

This article caters to individuals who are interested in improving their credit scores and maximizing their financial options. Whether you’re a young professional starting your credit journey or someone who wants to rebuild their credit, understanding the importance of an excellent credit score according to Experian will empower you to make informed decisions.

When Does an Excellent Credit Score Matter?

⌛ Your credit score becomes crucial whenever you apply for credit. Lenders and financial institutions rely on credit scores to assess the risk of lending you money. Having an excellent credit score increases your chances of getting approved for credit cards, loans, and other financial products. It also matters when you’re looking to rent an apartment, get a job, or negotiate favorable terms on insurance policies.

Building and Maintaining an Excellent Credit Score:

Building an excellent credit score takes time and consistent financial responsibility. It’s essential to pay bills on time, keep credit utilization low, avoid taking on unnecessary debt, and regularly check your credit report for errors or fraudulent activity. By maintaining these habits, you can protect and improve your credit score over time.

Where Can You Check Your Excellent Credit Score?

📍 Experian is one of the leading credit reporting agencies that provide individuals with their credit scores. They offer free credit reports annually, allowing you to monitor your credit health and identify areas for improvement. Additionally, Experian’s website offers various tools and educational resources to help you better understand credit scores and manage your finances effectively.

Take Control of Your Credit:

By regularly monitoring your credit score through Experian, you can stay informed about any changes or potential issues affecting your creditworthiness. Being proactive in managing your credit will empower you to make informed financial decisions and maintain an excellent credit score.

Why is an Excellent Credit Score Essential?

❗ An excellent credit score is essential because it opens doors to numerous financial benefits. It demonstrates your ability to handle credit responsibly and signals to lenders that you are a low-risk borrower. With an excellent credit score, you can secure better interest rates, higher credit limits, and more favorable terms on loans and credit cards. It also provides peace of mind, knowing that you have a solid financial foundation and can access credit when needed.

Maximizing Financial Opportunities:

Whether you’re looking to buy a home, start a business, or simply want to save money on interest payments, having an excellent credit score will give you an advantage. It allows you to take advantage of the best financial opportunities available and achieve your long-term goals.

How Can You Achieve and Maintain an Excellent Credit Score?

🚀 Achieving and maintaining an excellent credit score requires discipline and financial literacy. Here are some strategies to help you on your journey:

1. Pay bills on time:

Timely bill payments have a significant impact on your credit score. Set up automatic payments or reminders to ensure you never miss a due date.

2. Keep credit utilization low:

📊 Credit utilization ratio measures the amount of credit you’re using compared to your total available credit. Aim to keep this ratio below 30% to maintain a healthy credit score.

3. Diversify your credit mix:

Having a mix of credit types, such as credit cards, installment loans, and mortgages, can positively impact your credit score. Just ensure you manage them responsibly.

4. Limit credit inquiries:

When you apply for credit, each inquiry can temporarily lower your credit score. Minimize unnecessary credit applications to protect your score.

5. Regularly review your credit report:

🔎 Check your credit report for errors or signs of fraudulent activity. Dispute any inaccuracies promptly to maintain the integrity of your credit score.

Advantages and Disadvantages of an Excellent Credit Score

✅ While an excellent credit score is desirable, it’s essential to understand the advantages and disadvantages it may bring. Let’s explore both sides:

Advantages:

1. Access to the best financial products and terms

2. Lower interest rates on loans and credit cards

3. Higher credit limits

4. More negotiating power

5. Lower insurance premiums

Disadvantages:

1. High expectations from lenders

2. Potential for identity theft or fraud

3. Overconfidence in credit management

4. Limited credit history for younger individuals

5. Pressure to maintain a high credit score

Frequently Asked Questions (FAQs)

1. Can I achieve an excellent credit score without a credit card?

🔍 Yes, it’s possible to achieve an excellent credit score without a credit card. You can build credit through other means, such as loans, rental payments, or becoming an authorized user on someone else’s credit card.

2. How long does it take to achieve an excellent credit score?

⌛ The time it takes to achieve an excellent credit score varies for each individual. It depends on factors such as your current credit score, credit history length, and your financial habits. Consistently practicing good credit habits can help you reach an excellent score over time.

3. Will closing a credit card account affect my excellent credit score?

🚪 Closing a credit card account can potentially lower your credit score. It may impact your credit utilization ratio and reduce the length of your credit history. However, if closing the account is necessary, it’s important to consider the long-term implications and take steps to minimize the impact.

4. What should I do if I have a low credit score?

📉 If you have a low credit score, there are steps you can take to improve it. Start by reviewing your credit report for errors and disputing any inaccuracies. Focus on paying bills on time, reducing debt, and practicing responsible credit management. Over time, your score will gradually improve.

5. Can an excellent credit score guarantee loan approval?

🔐 While an excellent credit score increases your chances of loan approval, it does not guarantee it. Lenders consider multiple factors when evaluating loan applications, including income, employment history, and debt-to-income ratio. However, having an excellent credit score puts you in a strong position to negotiate favorable terms.

Conclusion: Take Charge of Your Financial Future

📝 In conclusion, an excellent credit score according to Experian is a valuable asset that opens doors to countless financial opportunities. By understanding what an excellent credit score is, who can benefit from it, when it matters, where to check it, why it’s essential, and how to achieve and maintain it, individuals can take control of their financial future. Remember, building and maintaining an excellent credit score requires discipline, responsible credit management, and regular monitoring. By implementing the strategies outlined in this article, you can pave the way for a successful financial journey and unlock the benefits an excellent credit score brings.

Final Remarks: Your Financial Journey Awaits

✨ The information provided in this article serves as a guide to help you navigate the world of excellent credit scores according to Experian. It’s crucial to remember that everyone’s financial situation is unique, and strategies that work for some may not work for others. It’s always advisable to seek personalized financial advice from professionals to make informed decisions based on your specific circumstances. By taking charge of your credit and practicing responsible financial habits, you can embark on a journey towards financial success and a brighter future.

This post topic: Excellent