Unlock The Power Of Excellent Vs Outstanding Credit Karma: Take Control Of Your Financial Future Today!

Excellent vs Outstanding Credit Karma

Introduction

Welcome, Smart People! Today, we will delve into the world of credit karma and explore the differences between excellent and outstanding credit karma. In this article, we will provide you with a comprehensive overview of these concepts, their significance, and how they can impact your financial well-being. So sit back, relax, and let’s dive into the intricacies of credit karma!

2 Picture Gallery: Unlock The Power Of Excellent Vs Outstanding Credit Karma: Take Control Of Your Financial Future Today!

What is Credit Karma?

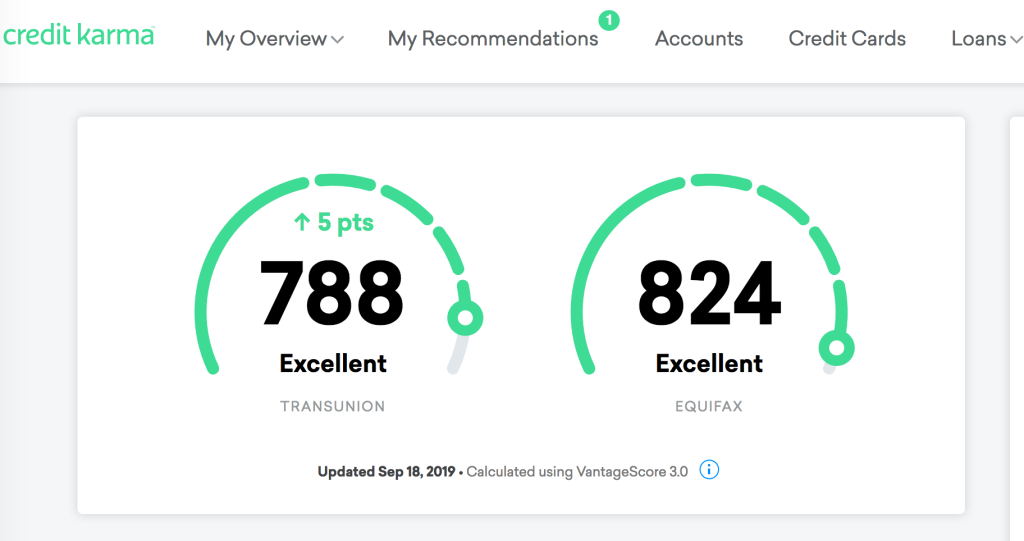

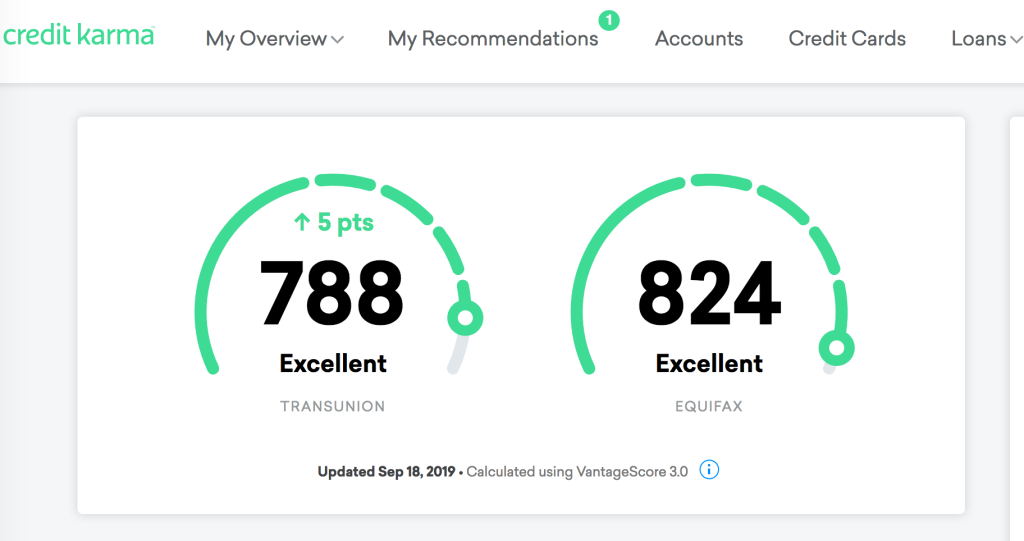

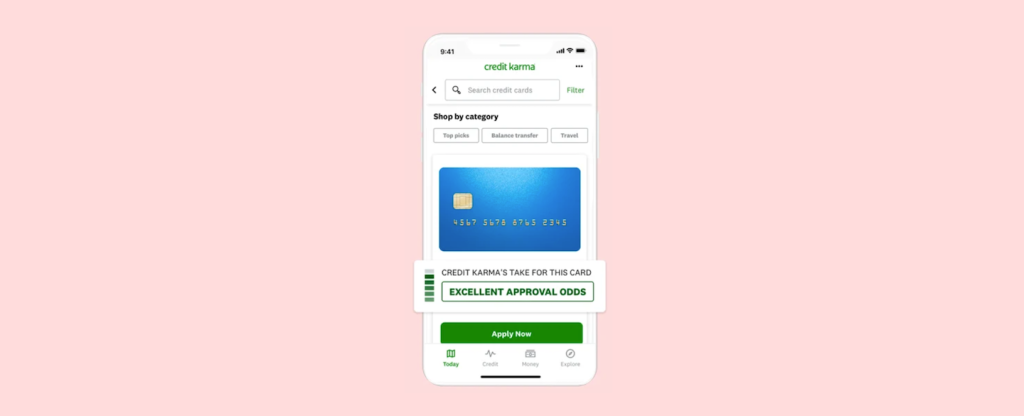

🔹 Credit Karma is a free online platform that provides users with access to their credit scores and reports. It offers personalized financial recommendations, educational resources, and tools to help individuals manage their credit effectively.

Image Source: website-files.com

🔹 The platform uses a credit scoring model to evaluate your creditworthiness based on various factors such as payment history, credit utilization, credit age, and more.

🔹 Credit Karma aims to empower individuals by helping them understand their credit profiles and make informed financial decisions.

Image Source: imgix.net

🔹 Excellent and outstanding credit karma are two categories that represent the highest level of creditworthiness.

Who Can Achieve Excellent and Outstanding Credit Karma?

🔹 Excellent and outstanding credit karma can be achieved by individuals who demonstrate responsible credit management, including timely bill payments, low credit utilization, a diverse credit mix, and a lengthy credit history.

🔹 It requires maintaining a strong credit score consistently over time and being proactive in managing your credit.

When Should You Strive for Excellent and Outstanding Credit Karma?

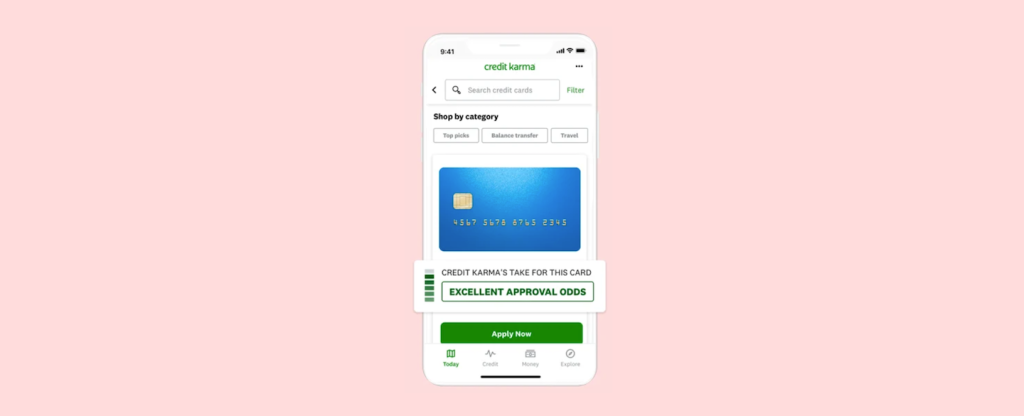

🔹 Striving for excellent and outstanding credit karma is beneficial in various situations, such as when applying for loans or mortgages, seeking favorable interest rates, or aiming to qualify for premium credit cards with exclusive rewards and benefits.

🔹 It is a valuable goal for individuals who want to strengthen their financial standing and have access to better financial opportunities.

Where Can You Monitor Your Credit Karma?

🔹 You can monitor your credit karma on the Credit Karma website or mobile app. By signing up for an account, you can regularly check your credit scores and reports to stay updated on your credit health.

🔹 Additionally, Credit Karma provides personalized insights and recommendations to help you improve and maintain excellent or outstanding credit karma.

Why is Excellent and Outstanding Credit Karma Important?

🔹 Excellent and outstanding credit karma can open doors to various financial benefits, including lower interest rates on loans and credit cards, higher credit limits, better insurance premiums, and increased chances of approval for rental applications and job opportunities.

🔹 It reflects your financial responsibility and reliability, making you a desirable candidate for lenders and financial institutions.

How Can You Achieve Excellent and Outstanding Credit Karma?

🔹 Building excellent and outstanding credit karma requires a disciplined approach to credit management. It involves paying bills on time, keeping credit utilization low, maintaining a healthy credit mix, avoiding excessive credit inquiries, and monitoring your credit regularly.

🔹 It is essential to practice responsible financial habits, avoid excessive debt, and take steps to rectify any errors or discrepancies in your credit reports.

Advantages and Disadvantages of Excellent and Outstanding Credit Karma

Advantages:

🔹 Access to lower interest rates on loans and credit cards

🔹 Higher credit limits

🔹 Improved chances of approval for rental applications and job opportunities

Disadvantages:

🔹 May require strict financial discipline

🔹 Potential impact on credit applications due to high expectations from lenders

🔹 Limited availability of certain financial products for individuals with outstanding credit karma

Frequently Asked Questions (FAQ)

1. What happens if I have excellent credit karma but my spouse has a poor credit score?

→ While having a good credit score is beneficial, lenders may consider the credit scores of both spouses when evaluating joint applications. It is essential to have open communication with your spouse and work towards improving their credit score.

2. Can I achieve outstanding credit karma if I have a limited credit history?

→ Building a strong credit history takes time, and individuals with limited credit history may find it challenging to achieve outstanding credit karma. However, by practicing responsible credit management and establishing a positive credit history, you can gradually work towards achieving outstanding credit karma.

3. Does checking my credit score on Credit Karma affect my credit?

→ No, checking your credit score on Credit Karma does not affect your credit. It is considered a soft inquiry and does not impact your credit score.

4. Can I trust the credit scores provided by Credit Karma?

→ While Credit Karma uses reputable credit bureaus to gather credit information, it’s essential to note that the credit scores provided may differ from scores used by lenders. However, Credit Karma provides a reliable estimation of your credit health and can serve as a valuable tool for monitoring and improving your credit.

5. Can I achieve excellent credit karma if I have had previous financial difficulties?

→ Yes, it is possible to achieve excellent credit karma even if you have had previous financial difficulties. By implementing responsible credit management practices, such as paying bills on time and reducing debt, you can gradually rebuild your credit and attain excellent credit karma.

Conclusion

In conclusion, maintaining excellent or outstanding credit karma is a valuable asset that can significantly impact your financial well-being. It opens doors to favorable financial opportunities, better interest rates, and increased chances of approval for various applications. By practicing responsible credit management, you can achieve and maintain excellent or outstanding credit karma, enhancing your overall financial standing.

Final Remarks

🔹 The information provided in this article is intended for informational purposes only and should not be considered as financial advice. It is always recommended to consult with a qualified financial professional for personalized guidance.

🔹 Remember that credit karma is just one aspect of your overall financial health, and it is essential to consider other factors such as savings, investments, and budgeting to achieve long-term financial stability.

🔹 Stay informed, be proactive, and make sound financial decisions to secure a bright financial future!

This post topic: Excellent